Points Paid On Purchase Of Principal Residence . instead, you divide the points by the number of payments scheduled over the term of the loan (360 monthly. qualifying for a tax deduction on mortgage points requires meeting several requirements,. the irs allows homeowners to deduct points as mortgage interest when certain conditions are met. Deductions reduce your taxable income for the. if it is your principal residence, you can deduct your points paid if you were getting a loan and you paid them out of your pocket, but it sounds like. yes, you can deduct points for your main home, if all of the following conditions apply: the term “points” is used to describe certain charges paid, or treated as paid, by a borrower to obtain a home mortgage. They're discount points (see the. learn how to deduct mortgage points paid on your main home or second home, and when to deduct them over the life of the loan.

from www.formsbank.com

qualifying for a tax deduction on mortgage points requires meeting several requirements,. learn how to deduct mortgage points paid on your main home or second home, and when to deduct them over the life of the loan. They're discount points (see the. Deductions reduce your taxable income for the. the term “points” is used to describe certain charges paid, or treated as paid, by a borrower to obtain a home mortgage. instead, you divide the points by the number of payments scheduled over the term of the loan (360 monthly. the irs allows homeowners to deduct points as mortgage interest when certain conditions are met. if it is your principal residence, you can deduct your points paid if you were getting a loan and you paid them out of your pocket, but it sounds like. yes, you can deduct points for your main home, if all of the following conditions apply:

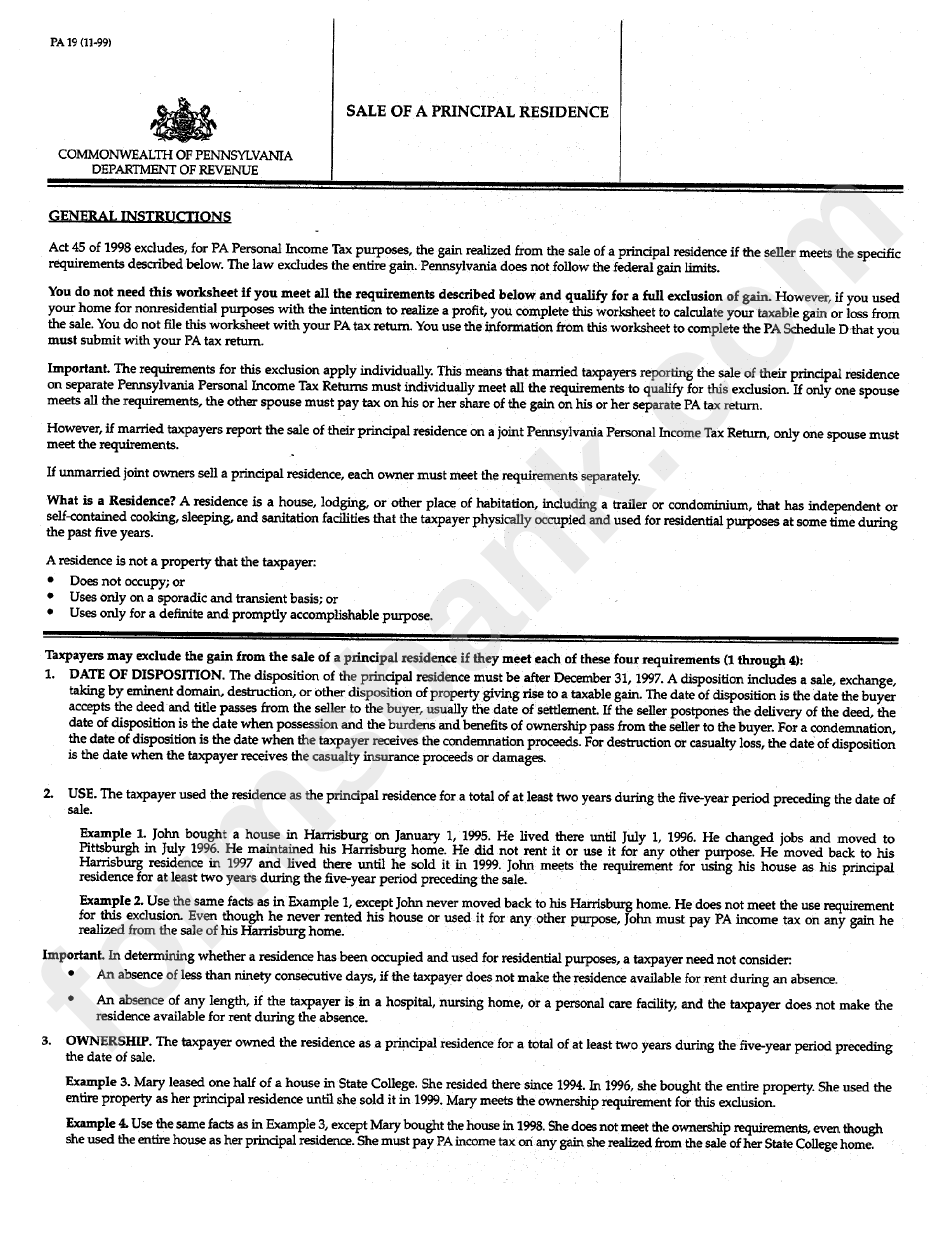

Form Pa19 Sale Of A Principal Residence Instructions Pennsylvania printable pdf download

Points Paid On Purchase Of Principal Residence They're discount points (see the. instead, you divide the points by the number of payments scheduled over the term of the loan (360 monthly. if it is your principal residence, you can deduct your points paid if you were getting a loan and you paid them out of your pocket, but it sounds like. the term “points” is used to describe certain charges paid, or treated as paid, by a borrower to obtain a home mortgage. qualifying for a tax deduction on mortgage points requires meeting several requirements,. learn how to deduct mortgage points paid on your main home or second home, and when to deduct them over the life of the loan. the irs allows homeowners to deduct points as mortgage interest when certain conditions are met. Deductions reduce your taxable income for the. yes, you can deduct points for your main home, if all of the following conditions apply: They're discount points (see the.

From studylib.net

designation of a property as a principal residence Points Paid On Purchase Of Principal Residence the irs allows homeowners to deduct points as mortgage interest when certain conditions are met. instead, you divide the points by the number of payments scheduled over the term of the loan (360 monthly. the term “points” is used to describe certain charges paid, or treated as paid, by a borrower to obtain a home mortgage. . Points Paid On Purchase Of Principal Residence.

From factprofessional.com

Sale of Primary Residence Calculator Fact Professional Points Paid On Purchase Of Principal Residence the irs allows homeowners to deduct points as mortgage interest when certain conditions are met. qualifying for a tax deduction on mortgage points requires meeting several requirements,. the term “points” is used to describe certain charges paid, or treated as paid, by a borrower to obtain a home mortgage. instead, you divide the points by the. Points Paid On Purchase Of Principal Residence.

From www.slideteam.net

Points Paid Purchase Principal Residence In Powerpoint And Google Slides Cpb Points Paid On Purchase Of Principal Residence if it is your principal residence, you can deduct your points paid if you were getting a loan and you paid them out of your pocket, but it sounds like. They're discount points (see the. yes, you can deduct points for your main home, if all of the following conditions apply: instead, you divide the points by. Points Paid On Purchase Of Principal Residence.

From www.taxcycle.com

Sale of Principal Residence (S3) TaxCycle Points Paid On Purchase Of Principal Residence learn how to deduct mortgage points paid on your main home or second home, and when to deduct them over the life of the loan. the irs allows homeowners to deduct points as mortgage interest when certain conditions are met. Deductions reduce your taxable income for the. instead, you divide the points by the number of payments. Points Paid On Purchase Of Principal Residence.

From www.slideserve.com

PPT Chapter 14. Home Ownership PowerPoint Presentation, free download ID4347218 Points Paid On Purchase Of Principal Residence the irs allows homeowners to deduct points as mortgage interest when certain conditions are met. instead, you divide the points by the number of payments scheduled over the term of the loan (360 monthly. learn how to deduct mortgage points paid on your main home or second home, and when to deduct them over the life of. Points Paid On Purchase Of Principal Residence.

From slideplayer.com

Property Transactions ppt download Points Paid On Purchase Of Principal Residence qualifying for a tax deduction on mortgage points requires meeting several requirements,. Deductions reduce your taxable income for the. the term “points” is used to describe certain charges paid, or treated as paid, by a borrower to obtain a home mortgage. instead, you divide the points by the number of payments scheduled over the term of the. Points Paid On Purchase Of Principal Residence.

From learningschooljprobste5.z4.web.core.windows.net

Primary Residence Letter Of Explanation Sample Points Paid On Purchase Of Principal Residence yes, you can deduct points for your main home, if all of the following conditions apply: Deductions reduce your taxable income for the. learn how to deduct mortgage points paid on your main home or second home, and when to deduct them over the life of the loan. instead, you divide the points by the number of. Points Paid On Purchase Of Principal Residence.

From quickbooks.intuit.com

Complete the S3 Principal Residence form in Pro Tax Points Paid On Purchase Of Principal Residence qualifying for a tax deduction on mortgage points requires meeting several requirements,. the term “points” is used to describe certain charges paid, or treated as paid, by a borrower to obtain a home mortgage. the irs allows homeowners to deduct points as mortgage interest when certain conditions are met. learn how to deduct mortgage points paid. Points Paid On Purchase Of Principal Residence.

From www.printablelegaldoc.com

Free Printable Offer To Purchase Real Estate Form (GENERIC) Points Paid On Purchase Of Principal Residence if it is your principal residence, you can deduct your points paid if you were getting a loan and you paid them out of your pocket, but it sounds like. learn how to deduct mortgage points paid on your main home or second home, and when to deduct them over the life of the loan. They're discount points. Points Paid On Purchase Of Principal Residence.

From www.taxcycle.com

Sale of Principal Residence (S3) TaxCycle Points Paid On Purchase Of Principal Residence They're discount points (see the. the irs allows homeowners to deduct points as mortgage interest when certain conditions are met. instead, you divide the points by the number of payments scheduled over the term of the loan (360 monthly. Deductions reduce your taxable income for the. yes, you can deduct points for your main home, if all. Points Paid On Purchase Of Principal Residence.

From realestatetaxtips.ca

How to Purchase Primary Residence with Corporation Real Estate Tax Tips Points Paid On Purchase Of Principal Residence instead, you divide the points by the number of payments scheduled over the term of the loan (360 monthly. yes, you can deduct points for your main home, if all of the following conditions apply: qualifying for a tax deduction on mortgage points requires meeting several requirements,. the term “points” is used to describe certain charges. Points Paid On Purchase Of Principal Residence.

From www.formsbirds.com

PA19 Taxable Sale of a Principal Residence Worksheet Free Download Points Paid On Purchase Of Principal Residence They're discount points (see the. the irs allows homeowners to deduct points as mortgage interest when certain conditions are met. qualifying for a tax deduction on mortgage points requires meeting several requirements,. instead, you divide the points by the number of payments scheduled over the term of the loan (360 monthly. yes, you can deduct points. Points Paid On Purchase Of Principal Residence.

From www.financialsamurai.com

Primary Residence Value As A Percentage Of Net Worth Guide Points Paid On Purchase Of Principal Residence Deductions reduce your taxable income for the. qualifying for a tax deduction on mortgage points requires meeting several requirements,. if it is your principal residence, you can deduct your points paid if you were getting a loan and you paid them out of your pocket, but it sounds like. the irs allows homeowners to deduct points as. Points Paid On Purchase Of Principal Residence.

From hemani.finance

Sale of Principal Residence HEMANI FINANCIAL SOLUTIONS Points Paid On Purchase Of Principal Residence They're discount points (see the. yes, you can deduct points for your main home, if all of the following conditions apply: learn how to deduct mortgage points paid on your main home or second home, and when to deduct them over the life of the loan. Deductions reduce your taxable income for the. the irs allows homeowners. Points Paid On Purchase Of Principal Residence.

From www.formsbirds.com

PA19 Taxable Sale of a Principal Residence Worksheet Free Download Points Paid On Purchase Of Principal Residence yes, you can deduct points for your main home, if all of the following conditions apply: Deductions reduce your taxable income for the. the irs allows homeowners to deduct points as mortgage interest when certain conditions are met. if it is your principal residence, you can deduct your points paid if you were getting a loan and. Points Paid On Purchase Of Principal Residence.

From www.realtaxtools.com

How to prepare 1098’s (mortgage interest statements) using W2 Mate program. Real Business Points Paid On Purchase Of Principal Residence the irs allows homeowners to deduct points as mortgage interest when certain conditions are met. qualifying for a tax deduction on mortgage points requires meeting several requirements,. Deductions reduce your taxable income for the. learn how to deduct mortgage points paid on your main home or second home, and when to deduct them over the life of. Points Paid On Purchase Of Principal Residence.

From eforms.com

Free Letter of Intent (LOI) to Purchase Residential Property PDF Word eForms Points Paid On Purchase Of Principal Residence the term “points” is used to describe certain charges paid, or treated as paid, by a borrower to obtain a home mortgage. instead, you divide the points by the number of payments scheduled over the term of the loan (360 monthly. the irs allows homeowners to deduct points as mortgage interest when certain conditions are met. They're. Points Paid On Purchase Of Principal Residence.

From www.chegg.com

Solved On March 31. year 1, Mary borrowed 190,000 to buy Points Paid On Purchase Of Principal Residence the irs allows homeowners to deduct points as mortgage interest when certain conditions are met. learn how to deduct mortgage points paid on your main home or second home, and when to deduct them over the life of the loan. the term “points” is used to describe certain charges paid, or treated as paid, by a borrower. Points Paid On Purchase Of Principal Residence.